#3: Silicon ka, Signature ka, sabka badla lega humara SBI (after lunch)

Tune in for some refreshing nursery rhymes

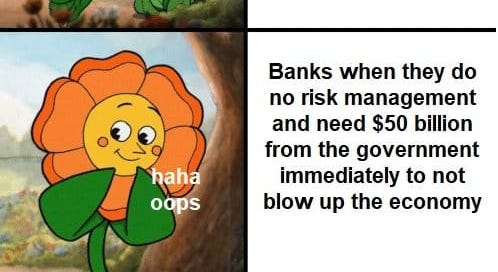

Amidst the chaos in US banking space, the below playschool rhyme succinctly captures the saga of SVB from featuring among the stars at Forbes’s to biting the dust in a week…

Humpty Dumpty sat on a wall,

Humpty Dumpty had a great fall,

All the king's horses and all the king's men,

Couldn't put Humpty together again.

Fall of Silicon Valley Bank:

A classic case study of Interest rate and liquidity risk

What is SVB?

- SVB, was the 16th biggest bank in America and used to provide services to nearly half of the venture-backed technology companies in the US.

- SVB's deposits more than quadrupled – from $44 billion at the end of 2017 to $189 billion at the end of 2021 – while its loan book grew only from $23 billion to $66 billion.

What went wrong at SVB?

- SVB invested most of its deposits in government bonds when the interest rates were low.

- The interest rate hikes by Fed to cool inflation began last year. Bond prices fall when interest rates go up. Huge accumulated losses were piled up at SVB.

- Increase in Customer’s withdrawal request to meet their operating expense. The bank was forced to sell some of its investments despite the plunge in value

- It took a $1.8 billion hit on the sale of some of those securities and they were unable to raise money to offset the loss. These announcements created a panic among their investors, and its stock fell 60%.

- California regulators seized the bank and put the Federal Deposit Insurance Corporation (FDIC) in charge of all the deposits.

-(FDIC) has created a bank that will protect both insured and uninsured depositors at SVB.

Pharma trends ki Vocabulary

Innovator Focus - Even though digital technology is increasingly being used by pharma companies, they have just started to scratch the surface. One aspect of digitization is that it can cut down on the time taken for clinical studies, helping pharma cos to reduce the launch-to-market time.

Generic Focus -There is a shortage on the available sterile drugs across the globe. For some drugs, the market unmet demand is almost equal to, if not more, than the current market size. With more drugs coming off-patent, there is a huge impetus for the Indian generics market in near future.

Sterile drugs - Dosage form of a drug that is essentially free from living microbes & chemical or physical contamination

Where will AI generate returns? No, it's not a startup thing

Obvious stuff:

People making Chips (NVIDIA, TSMC etc) - Far more compute required.

People with cloud distribution (Microsoft, Amazon, Google) - Existing infra to rent compute

People with consumer distribution (Meta, Amazon, Adobe) - Use existing data and engagement

People with IPs (Disney, Warner bros) - Make iron man talk to you

Non-obvious stuff:

Enterprise storage (Dropbox and box) - Run AI on all data stored

IT Services (IBM, TCS, Accenture) - Similar to the cloud transformation story

House of Brands (HoB)/ Thrasio Model

-First depicted by Thrasio in the US, the model involves acquisition of brands and integrating them under a common umbrella.

-Objective involves (i) Higher growth with better business building expertise and efficient marketing (ii) Reduction in costs with optimized fulfillment and absorption of corporate overheads

-Typically, HoB players focus on select product categories for higher syngergies

-Top players in India include Mensa Brands, Globalbees, GOAT brand labs, Upscalio, The Good Glamm Group

The democratisation of Warehousing in India

1)21% Y-O-Y growth in 2022. Top 8 cities supply;307M sq.ft, expected to grow to 500M sq.ft by 2025. Grade A warehouses constitute 47%.

2)Avg Grade A warehouse size has gone from 80K to 1.6L sq.ft. Avg volume for Grade A warehouse has gone up 3x to 64L cu. ft.

3)Supply growing @CAGR of 20%, demand @19%. Average rent per sq ft for Grade A - Rs 23 per sq ft and for Grade B Rs 19 per sq. ft.

4)Sectoral Absorption- 43% 3PL, 20% Auto+Engineering, 16% FMCG, E-Commerce 4%, Others -17%.

5)Emerging trends - Grade A warehousing, Tech Adoption & ESG.

6) Investment needed in the next 3 years to fulfil demand - $3.8B.

7) Recent funds-Welspun One-$250M & IndoSpace Logistics Park IV-$600M.

India EV story picking up speed

- TI Clean Mobility (Murugappa Group Company) raises record investment of INR 1,200 Cr. TI Clean Mobility has developed a 3W EV for cargo and passenger and is (pre revenue stage with FY22 PAT loss of c. INR 11.3 Cr.)

- Pricol gets interest from Minda as it acquires 16% for INR 400 Cr. Pricol portfolio includes screen display systems (> c. 50%) and telematics for fleet management.

PP: Whether the current battery management systems are sophisticated enough to create a vehicle which can endure Indian roads?

- Businesses working towards more efficient battery management systems (BMS) to look out for!

- OEMs currently evaluating almost all players for a BMS solution, need to wait to see wallet share split.

Cement sector’s bond getting stronger:

-India is the 2nd largest cement producer in world & accounted for ~7% of the global installed capacity

-India has a capacity of ~550 Mn tons with ~65% utilization rate. Real estate accounts for ~60% of cement demand.

-Ultratech, ACC, Ambuja, Shree Cement & Dalmia hold ~50% of capacity in India with Ultratech being the largest (~125 Mn T)

- Industry is witnessing consolidation. Recent deals include Adani acquisition of Ambuja ACC, PremjInvest acquiring stake in Sagar cements, etc.

-Cement is a bulk commodity, with a price of Rs 7-8/kg. Sold in 50kg bags.

Normally, the price rise happens in the range of 2-4% in Q4 every year but this year, there have been no hikes since the firms are trying to increase their market share & volumes

Compiled by Hanu Bansal & Tushar Khandelwal

Contributions by Arnim Dhakad, Ashish Purohit, Anand Vadia, Mukund Maheshwari, Parin Detroja, Prachi Malpani, Tanay Lohia, Udit Bhandari.

Join our community waitlist here. We update our job board every week here.

PS: Excited to announce our guests for the 6th CAtch Up on 26 March, Sunday!!

We bring you a Consumer-themed mixer this time!

These consumer stalwarts will join participants to lead our mega-townhall

1. Sridhar Sankararaman: MD, Multiples ($1Bn AUM)

2. Dhvanil Sheth: Founder, Skillmatics (Sequoia Surge)

What an interesting doze of information!!